The craze of cryptocurrency is growing day by day and gaining widespread acceptance all over the world. A cryptocurrency is a form of digital money based on a network distributed across thousands of computers. This virtual currency exists outside the control of governments, banks, or any sort of authorities. It is captivating the attention of many for investment and capitalization.

As it has evolved as a phenomenon and, more greatly, as it is very accessible, everyone wishes to become a cryptocurrency merchant. Almost like any other aspect of trading, cryptocurrency trading is also accomplished depending on practical principles and methods that every investor should follow. Following are some of the widespread mistakes every crypto trader should avoid while buying it:

9 Common Mistakes To Avoid While Buying Cryptocurrency

1. Not Possessing A Goal

Beginning cryptocurrency purchases in absence of goal formation can lead to one’s investment going erratic and cannot prove to be price-beneficial and profitable as could have been otherwise.

A nicely conscious objective assists one to steer seriously in the cryptocurrency world. One must have an apparent objective before one moves to the cryptocurrency business. The aim must not be steered through Fear Of Missing Out (FOMO) or by the wish to prepare a fast move.

2. Quick Term Thinking

It is very crucial for investors to observe the involvement of cryptocurrency for an extended term because of the erratic and premature character of the market. As many fresh things are always tested repeatedly in the crypto market, it is too developing and uncertain. The demand can grow at one time and deteriorate at a different time. An approach that is long-lasting will benefit one to collect adequate recoveries.

3. Directly Moving To Trading Without Any Knowledge

It is very crucial not to buy from the cryptocurrency market rapidly in the absence of proper knowledge because of the unexpected behavior of cryptocurrencies. Deep exploration and knowledge involving specialized examination of cryptocurrencies are very important before we capitalize on cryptos. However, there are trading specialists that could assist one to increase the skills of trading with cryptocurrency. This process is known as Paper trading.

4. Possessing No Strong Plan

The significance of a plan while buying cryptocurrency cannot be one that could be over-prioritized. A nice plan needs to take into account the coming and departure junctures before one goes for trading in cryptocurrency.

The entrance juncture is the cost at which cryptocurrency is purchased and the departure juncture is the cost at which it is auctioned with a definite interest margin. New and novice investors must never trade depending on belief, as they would turn out endlessly going for maximum prices.

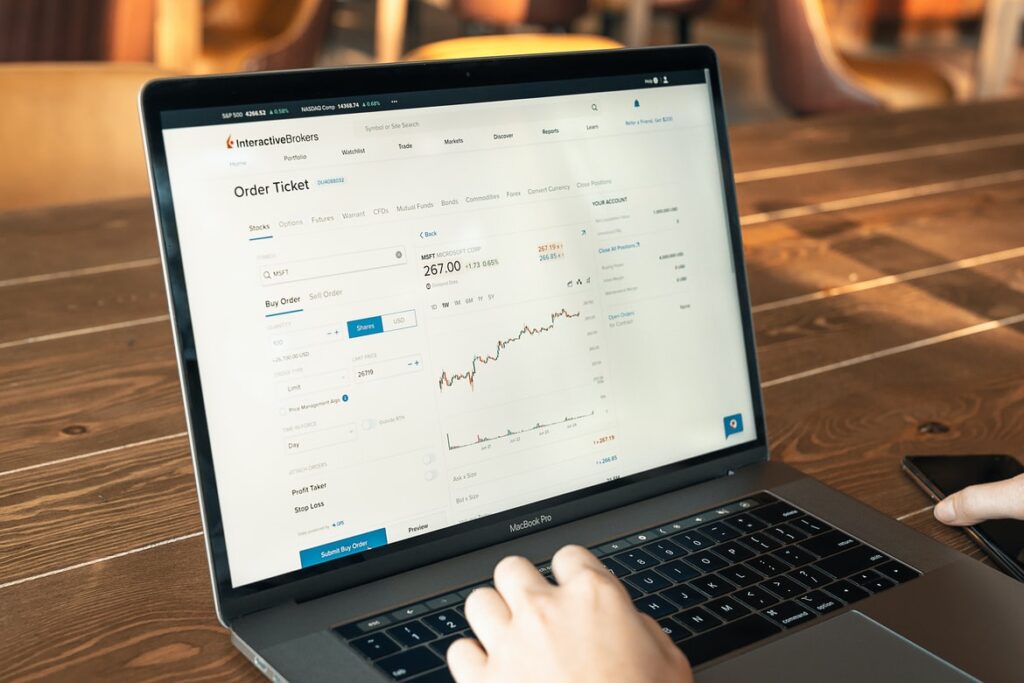

5. Trading On An Insecure Platform

It is of no use to say that one must often choose the cryptocurrency exchanges that are loyal, secure, and trust-seeking. With the expansion of crypto platforms with the constant increase of the crypto industries, numerous criminal actions and crimes are moreover being executed by hoax exchanges of cryptocurrency.

6. Not Securing Private Keys

When one buys cryptocurrency, either it is Ethereum or the almighty bitcoin, one should have a digital wallet. A digital wallet is one that can ensure the possession of cryptocurrency. Like a mobile phone, the digital wallet could be protected with personal keys.

Private keys assist to secure one’s cryptocurrency from being snatched by ravaging cyberpunks. Negligence to protect our private keys, which are frequently illustrated as a sequel of alphanumeric characters, could leave one’s cryptocurrency at danger. Thus one should protect our private keys, as it consents access to our crypto possessions.

7. Financing Money One Cannot Afford To Lose

Cryptocurrency is a nice path to amass a decent modest income. It has assisted several individuals to obtain wealth. Looking at that, we can see that when we buy cryptocurrency, one should not commit the error of investing money that is meant for one’s college education or urgent payments all because one wants to become super-rich. But this is not advisable.

Even crypto specialists do not invest money which is for crucial payments. Instead, they capitalize money they can pay to lose. This means, rather than utilizing the house rent to buy cryptocurrency, we should contemplate using the limited 200 dollars one needs to assess the waters. The goal is for investing cash one can afford to miss because cryptocurrency is relatively uncertain.

8. Only Investing In Bitcoin

A deviating portfolio is a nice way to preserve oneself against instability. One needs to not only capitalize on different non-crypto possessions, but one may wish to vary one’s crypto investments also. This means, if Bitcoin ceases to function, we won’t have to suffer much. If one likes to blend things within one’s crypto forum, there are a bunch of coins to select from.

However, like with Bitcoin, one needs to explore before trading. Glancing for highly-ascertained coins with respected names should be the main aim of every person. Every coin has a white paper which one can read to comprehend what the coin would do and who is involved. Also, fictitious coins are another way hackers cheat investors out of cash and wealth.

9. Being Greedy

Recognizing the importance of the crypto portfolio increase in a particular market is fascinating, surely. But, one should be careful not to get trapped in the publicity of trying to hold out for the cost to climb as high as one would wish it would advance a specific cryptocurrency. So one should capitalize responsibly and recall to take profits as crypto prices are rising continuously.

Do not proceed with rath investing just by getting your passion triggered by the success stories of others. If profit-making is your goal and you lack adequate knowledge of crypto investing, being a crypto affiliate marketer would help in gaining benefits in the least possible time. Click here to become an affiliate crypto marketer.

Conclusion

Having understood the common mistakes one makes when buying cryptocurrency, one should keep in mind that if one commits a stupid mistake, it would be very difficult to recover the money since the market is very fragile. Thus, one should remember to ensure and maintain vigilance when one buys and sells cryptocurrency.