How to Stay Afloat Financially When You Lose Your Job

Life is unexpected. It is almost impossible to forecast the future and get prepared for all possible challenges. The Covid-19 pandemic, economic crisis, wars in the world… All these factors have a great influence on our life, work, and income.

Due to it financial anxiety has become a popular issue for people all around the world. “If I lost my job now what will I do?” – you may ask yourself. The first thing you have to know is the fact that you are not alone. Unemployment is one of the most widely spread problems all around the world.

You should know that it is alright to have such a fear but it is not okay to ignore it. Don’t be afraid and don’t hesitate to ask for any help if you need it. Talk to your family, ask friends, and take the opportunity to get a free consultation from a psychologist or financial specialist. But what should a person do in case of losing a source of income? Let’s get a closer look into this issue together.

Apply to Money Lenders

If you can’t find an alternative position and don’t have any savings, there are still no reasons for feeling depressed and desperate. Luckily, you can apply to alternative money lenders to get a fast loan. Thanks to such lending platforms as triceloans even officially unemployed people can borrow money.

The most popular service here is opening a credit card. In such a way you will be able to satisfy your basic needs till you find a new working place. However, don’t take it for granted. You will be obliged to pay off the whole sum.

Anyway, you won’t be required to repay your loan in one day or a week. The only thing you should do is to make a minimal contribution each month. Mobile lending apps are more beneficial when compared with banking establishments because they set lower requirements for the borrowers. To get the financial support you don’t have to look for the nearest office, stay in queues, deal with piles of documents or even go out from home.

Preventive Measures

If you suffer from financial anxiety and ask yourself the questions like “what would I do if I lost my job?” then you should start with taking preventive measures. On the other hand, if you are not prepared for such a scenario take a deep breath and start thinking about your future.

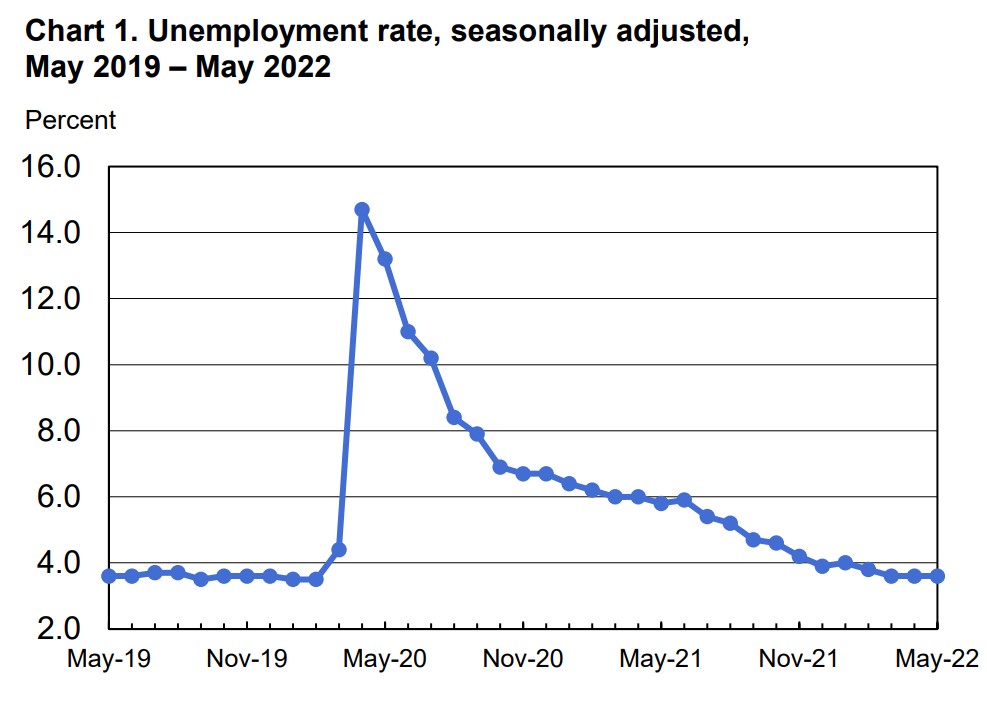

There are a lot of interesting investigations devoted to this issue. According to the Bureau of Labour Statistics, the unemployment rate in the USA is nearly 4 percent. It means that this issue is relevant to many people.

Everyone knows that it is of paramount importance to save money on a rainy day. In fact, just a few manage to do it in real life. Financial education is the main aspect that defines your future standard of living. To manage your budget effectively you have to self-educate and take control of your finances.

Try to save at least 10% of your income each month. Even if the sum seems miserable after several years it will serve you as an airbag. Such savings are essential. It is believed that a perfect “stash” is the one that allows you to be out of work for 3-4 months. In such a way, if you lost your job you will have an opportunity and time to look for another appealing work offer for you.

Thanks to it, you will be more selective and won’t settle for less. At first, it may be difficult for you to save money without having a particular purpose like buying a new smartphone, car, or house. But then it will turn out into a useful habit. If you still have doubts, you should try it!

Look for New Opportunities

Well, let’s face it. You have lost your job and need money right now. Such a situation is quite possible considering the modern realities. In such a case you are strictly forbidden to get depressed and actionless. The labor market is rather enormous and diverse. You should at least try to search for some kind of work. What can it be?

The 21st century allows you to earn money from home with the help of your laptop or even your mobile phone. Freelance wins more and more proponents. All you have to do is to find something you are good at. You may know foreign languages, draw interesting pictures, write songs, take photos, or even teach other people. Your skills are your treasure. If you will really do your best to find a source of income, you will cope with it. Luckily, there are a lot of options for those who need them.

Trace Your Expenditures

The first thing you should be taken care of is your obligatory monthly expenses that cannot be postponed. Among such expenditures are rent, repayment on loans or mortgages, utility bills, tuition fees, the cost of food, medicine, and basic necessities.

It will be very difficult to move on without satisfying these needs. That is why you have to sit back and calculate your budget for the next month or two. If you define your basic needs, it will be easier to manage your savings wisely and afford a comfortable living. Following this strategy will prevent you from making purchases on a whim and running out of money.

Don’t Postpone The Job-Searching Process

It is possible to find a new job even during quarantine. Some companies may have harsh times, while others will require a new labor force. There are also businesses that have decided to switch to remote work and are looking for freelancers or distant employees. In such a way it is better not to procrastinate with finding a new job, even a temporary one for the first time.

Final Thoughts

The most convenient way to get money for making your ends meet is to make use of online lending services. Such platforms usually don’t ask about the purpose of your borrowing and can give you money even if you have a bad credit history. However, before you apply for financial assistance find an alternative source of income, even a small one. For money lenders, it will serve as proof that you will pay back the whole sum with the flow of time.