In an era dominated by data-driven decision-making, the Death Master File (DMF) stands as a crucial yet often overlooked repository of invaluable information. This meticulously curated database contains records of deceased individuals, encompassing a wealth of demographic details, vital statistics, and historical insights.

In this article, we will look at the impact of DMF on various industries and its applications in various fields.

Death Master File Overview

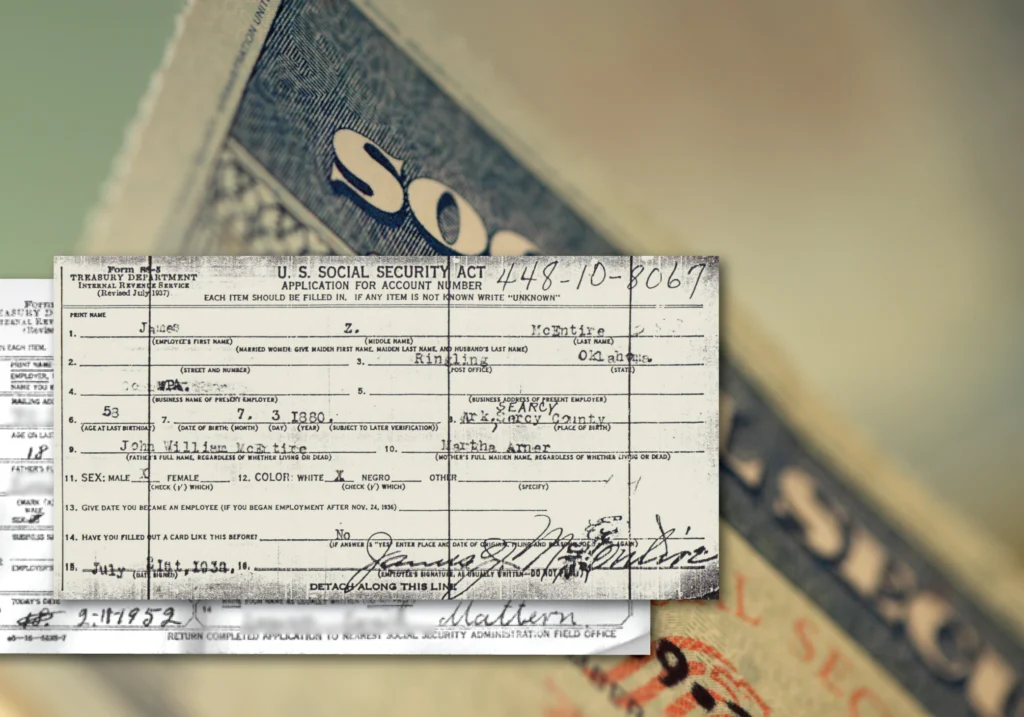

The Death Master File (DMF) is a database that contains records of people who have died in the United States. The United States Social Security Administration (SSA) maintains this database.

The DMF was primarily used for administrative purposes by the SSA, but today, it serves as a vital data resource for a wide range of entities by providing essential information for activities such as verifying identity, preventing fraud, conducting demographic research, and managing benefit distribution. This database contains more than 94 million records.

What Information does the DMF contain?

The Death Master File, also known as the Social Security Death Index (SSDI), contains the following information: surname, given name, date of death, date of birth, last known residence, location of last benefit, date, and place of issuance. Official organizations monitor the registration procedure as part of their administrative protocols for vital statistics and social security records.

Who Has Access to the Death Master File

Access to the entire DMF is usually restricted to specific groups and organizations for specific purposes. and those who want access, whether organizations or individuals, have to fulfill specific requirements and submit an official application process. To summarize, access to the DMF is strictly regulated.

Death Master File Guide

A death master file guide is a comprehensive reference manual that provides detailed information and instructions on how to effectively utilize the Death Master File (DMF). It offers insights into various aspects of the DMF, including legal and regulatory compliance, data field interpretations, and best practices for responsible use.

This guide is intended to help users navigate the database’s intricacies while adhering to industry-specific norms of conduct and protecting the privacy and respect of departed individuals and their families. It may also include practical examples, case studies, and tips for preventing fraud and identity theft.

Ultimately, the Death Master File guide serves as an invaluable resource for individuals, businesses, and organizations seeking to harness the power of this vital database in a responsible and ethical manner.

Changes to the SSDI Over the Years

The Death Master File (DMF) has evolved over the years in some ways:

- With advancements in technology, SSDI was transformed into a digital format, allowing for more efficient data entry, retrieval, and management.

- The DMF initially had only basic information such as names, dates of birth and death, and places. Additional data fields were added over time.

- Stricter controls and certification criteria were implemented at the time to prevent misuse, particularly for objectives such as identity theft protection.

- The DMF has integrated with various other systems and databases, allowing for seamless sharing of information among different government agencies and authorized entities.

- To protect against unauthorized access or breaches, security protocols, and measures have been continuously strengthened.

DMF as a Vital Resource for a Variety of Industries

The Death Master File Is Essential for Insurance

The DMF is important in the insurance industry for several reasons:

- Insurance fraud steals at least $308.6 billion from American consumers each year, according to statistics. In this example, the Death Master File (DMF) is a potent tool that businesses may use to prevent insurance fraud. Insurance companies can cross-reference their policyholder data with the DMF to identify any discrepancies.

- When a claim is filed, insurers can use the DMF to verify the status of the claimant.

- By checking applicant information against the DMF, insurers can confirm the legitimacy of identities. This is particularly crucial in preventing cases of individuals assuming false identities to obtain insurance policies.

- Proactively preventing fraud not only saves money but also enhances the trust and satisfaction of legitimate policyholders.

Uses of the Death Master File in the Finance Industry

The graphs below show the value of fraud loss in the United States in 2022, broken down by payment method, which is very concerning and is one of the main reasons why finance companies use the DMF:

- Financial institutions use the DMF to verify the identities of individuals applying for loans, credit cards, or other financial products.

- Companies offering annuities or pension plans use the DMF to identify deceased recipients. This ensures that payments cease promptly, preventing overpayments and fraudulent claims.

- Pension funds and retirement plan administrators use the DMF to track participant status and prevent payments to deceased retirees.

- Credit bureaus and reporting agencies use the DMF to update credit records.

Overall, the Death Master File is an invaluable tool for maintaining the integrity and security of financial transactions and accounts, as well as ensuring compliance with regulatory standards within the finance industry.

Conclusion

The Death Master File (DMF) is a vital but frequently overlooked collection of information in the field of data-driven decision-making. From its inception within the Social Security Administration, the DMF has evolved into a versatile resource with wide-ranging applications in industries such as healthcare, finance, genealogy, and insurance. Its transformation into a digital format and expansion of data fields reflect a commitment to accuracy and relevance.

Moreover, the integration with other systems and heightened security measures demonstrate a dedication to maintaining the integrity of this critical database. A Death Master File guide serves as an indispensable companion, offering insights into legal compliance, data interpretation, and ethical use, ensuring that the DMF remains a cornerstone of reliable and responsible information for years to come.